Land trusts, which are real estate-based trusts, are frequently utilized in estate planning. It’s designed to be used for property management throughout your life. They are revocable trusts, which means they can be altered or dissolved at any time. Real estate (such as buildings or homes) as well as property notes and mortgages can be held in land trusts. They’re usually employed for land that’s being used for conservation or wildlife, or for real estate development. The grantor, trustee, and beneficiary are the three main components of a land trust. The grantor is the person who establishes the trust and transfers the assets. The trustee is in charge of the trust, while the beneficiary is the one who benefits from it.

A land trust is a legal entity made up of three parties: the grantor, the trustee, and the beneficiary. These are the same people who are involved in any other trust. The landowner is the grantor, and in most situations, the landowner is also the beneficiary of a land trust. The trustee is the person or company who, at least on paper, assumes ownership of the property. A land trust might have several beneficiaries and co owners. There is an extra benefit to the grantors when a land trust involves numerous owners. If one of the owners is sued, the trust can protect the other owners.

Selecting a trustee for the property is the first step in creating a land trust. Landowners must be vigilant in selecting qualified, credible trustees, given the fiduciary relationship of a land trust and the legal and financial repercussions of a land trust that does not follow state regulations.

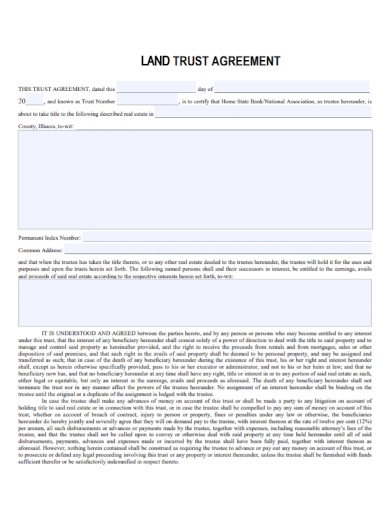

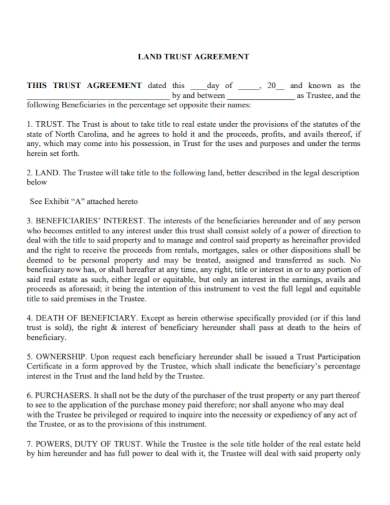

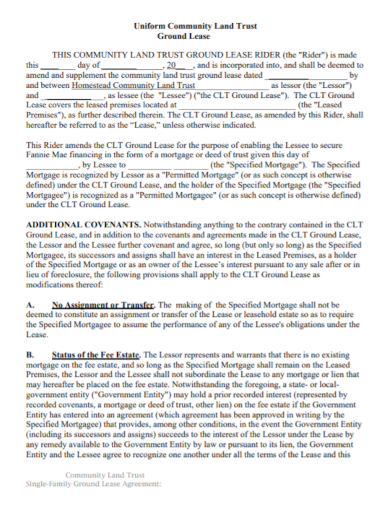

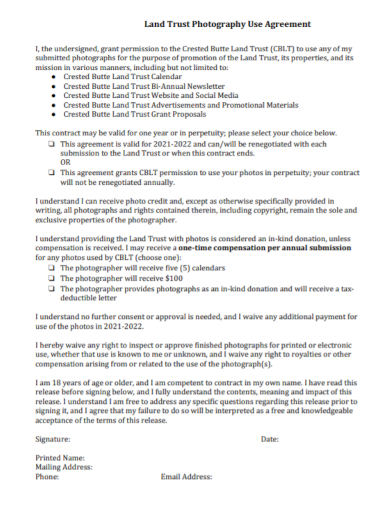

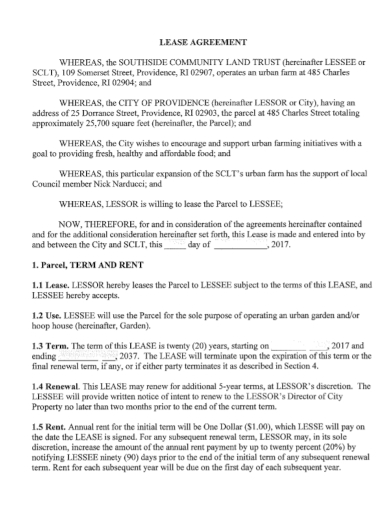

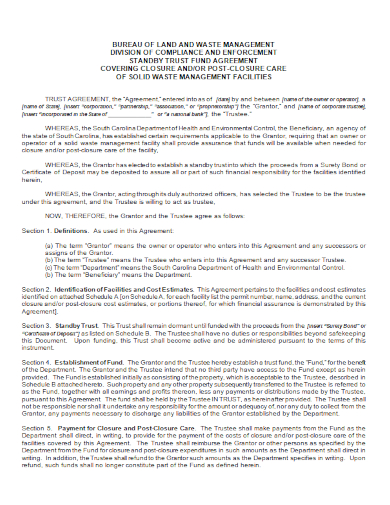

After you’ve decided on a trustee, you’ll need to establish up your land trust by signing a deed in trust and a land trust agreement. These two documents establish the terms of the land trust.

The manner in which these contracts are executed, as well as the provisions of the documents themselves, are unique to the state in which the land trust is created. You’ll need an attorney who is familiar with land trusts in your area because the nuances differ by state. Fees will be charged.

A title-holding trust allows the owner of the property to keep all rights to the property while remaining anonymous and directing the land trust’s actions. Because they were first popularized in Chicago during the 1800s, these trusts are often referred to as “Illinois land trusts.” Property owners in the same areas where they owned land were not authorized to vote on city projects at the time. To get around the prohibition, affluent businesspeople and politicians would form land trusts to buy land secretly, preserving their voting privileges.

Land trusts have the advantage of providing liability and privacy safeguards. It permits real estate investors to keep their property and personal funds separate. The use of a land trust helps to keep the details of one’s net worth hidden. Land trusts are frequently used by real estate investors to maintain their property distinct from their other assets.

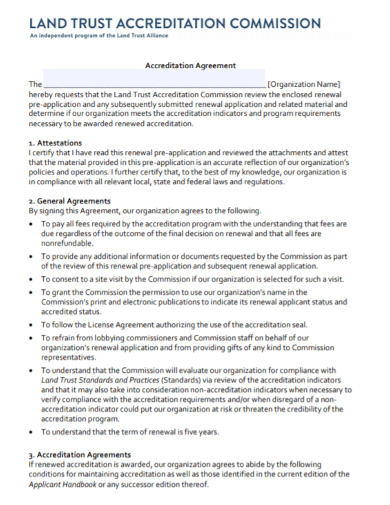

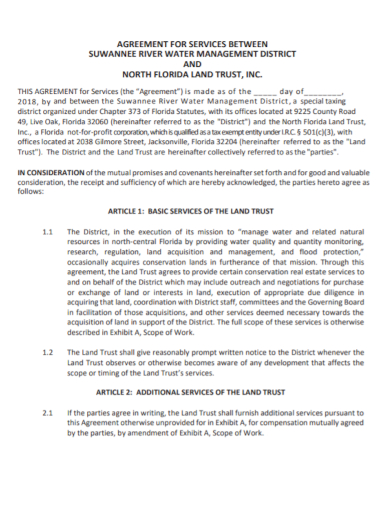

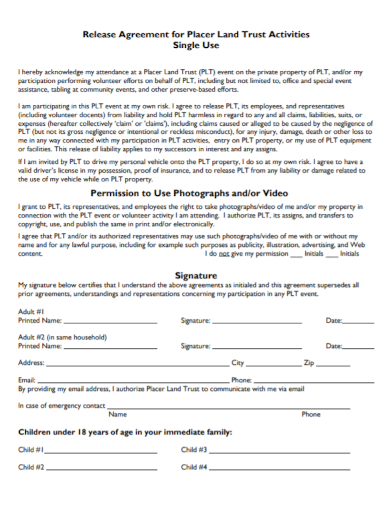

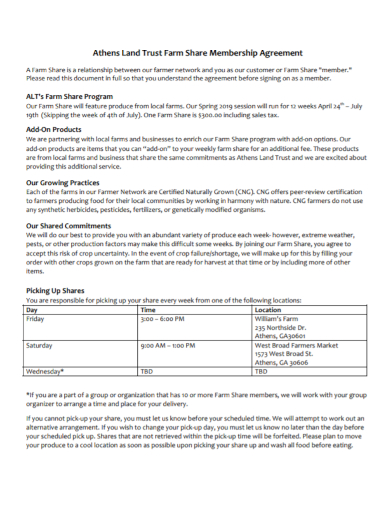

If you want to see more samples and formats, check out some land trust agreement samples and templates provided in the article for your reference.